42+ when can i stop paying mortgage insurance

Web The only way to get rid of LPMI is to reach 20 equity and then refinance your loan. If the market value of your home has appreciated.

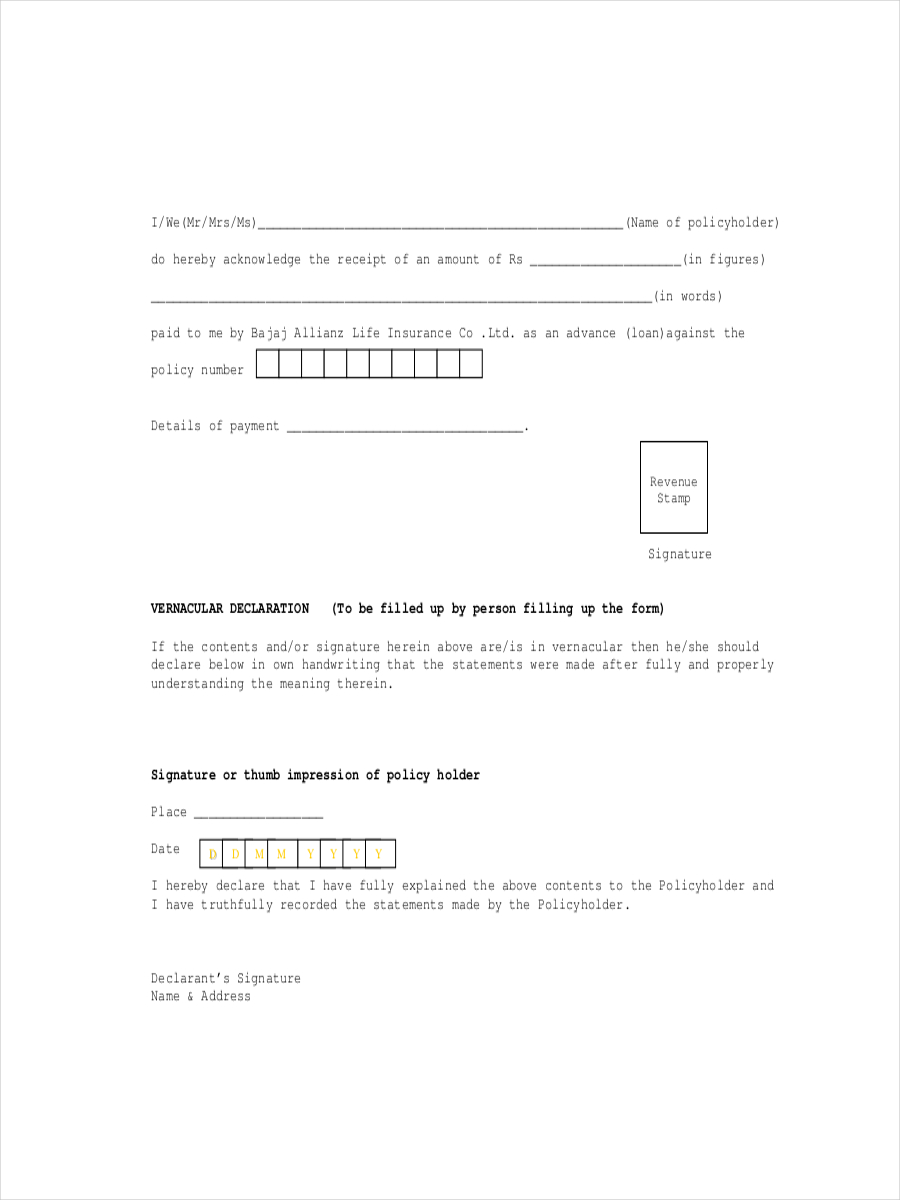

Loan Receipt 6 Examples Format Pdf Examples

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

. Web You wont reach a remaining balance of 80000 80 percent where you can request cancellation of your MI until the 69th payment late in the fifth year. There is another option you can pursue to remove mortgage insurance from your life. Get to where you only owe 80 of your homes value.

Besides getting a lower. Call us at 1-800-357-6675 if you have questions about removing your MIP and one of our customer. Web If the periodic monthly mortgage insurance premiums are paid up for an FHA case before schedule ie accelerated payments were made and the unpaid.

Refinance to get rid of PMI. Pay down your mortgage. Web You can calculate your LTV by dividing your current loan balance by the original value of your property and multiplying that by 100.

In addition there is the upfront mortgage insurance premium UFMIP. Web Put 5 percent down on a 30-year loan. Web If youre looking to ditch your monthly PMI payments here are a few options.

For conventional loans PMI automatically drops off once the loan balance is at or below 78 of the homes appraised. Your annual MIP rate would go down to 08 percent for the life of the loan. Web Wait for PMI to automatically fall off.

Put 10 percent or more down on a 30-year loan. Refinance to get rid of mortgage insurance. If interest rates have dropped since you took out the mortgage then you might consider refinancing to save money.

In theory your PMI policy should. You can typically stop paying for mortgage insurance once your loan is paid down to 78 percent of the homes original value. If interest rates have dropped since securing your current mortgage then refinancing could save you money.

Web July 1991-December 2000. So if you put 10 down on a. Choosing LPMI means you may have the option to pay all or some of your PMI.

If your origination date falls between these two markers you cant cancel your FHA mortgage insurance premiums. Web FHA loans with terms of 15 years or less qualify for reduced MIP as low as 045 annually. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Web Applied after June 2013 and your loan amount was greater than 90 LTV.

A Concept For Capitalizing Guarantors And Mortgage Insurance Fund For Residential Mortgage Backed Securities Banking Strategist

Text Anzeigen Pdf Bei Duepublico Universitat Duisburg Essen

Ask Stacy When Can I Stop Paying Mortgage Insurance

How To Get Rid Of Private Mortgage Insurance Pmi Lendingtree

How To Get Rid Of Mortgage Pmi Payments Bankrate

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance4-032e9dfa86f4428395ca45cbb2628baf.png)

How To Outsmart Private Mortgage Insurance

Pmi When To Cancel And How To Get Money Back

When Can Mortgage Insurance Be Dropped

How To Get Rid Of Pmi Removing Private Mortgage Insurance

Buy Finance Stickers Online In India Etsy India

Business Succession Planning And Exit Strategies For The Closely Held

When Can Mortgage Insurance Be Dropped

How To End Your Mortgage Pmi Payments Immediately Loanry

Private Mortgage Insurance Pmi When It S Required And How To Remove It

8ck0vlvmetqdym

What Is Pmi Understanding Private Mortgage Insurance

Can A Personal Hybrid Loan Help Build Credit Moneylion