Mass sales tax calculator

Simply follow the five basic steps below. Massachusetts sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

State Corporate Income Tax Rates And Brackets Tax Foundation

10 of the additional tax.

. Why A Reverse Sales Tax Calculator is Useful. The buyer pays the sales tax as an addition to the purchase price to the vendor at the time of purchase. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

15 - Massachusetts Use Tax View Main Article. The calculator employs four powerful algorithms the Boer the James the Hume and the Peters equations to calculate your LBM. Up to double the tax amount determined to be due.

The units used for measurements are therefore mass per unit volume. Authority Rta Raised from 7 to 105. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Raised from 685 to 81 Moro and Saint Jacob. Towns school districts and counties all set their own rates based on budgetary needs. UK Tax.

Sales tax total value of sale x sales tax rate. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. Our calculator has recently been updated to include both the latest Federal Tax.

Mass if we look from a physicists perspective can be defined as a measure of the quantity that is inside a body excluding such factors as the volume of an object or any forces that might be acting on the object. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or rented in Massachusetts. United States Salary Tax Calculator 202223.

The Massachusetts sales tax rate is 625 as of 2022 and no local sales tax is collected in addition to the MA state tax. It is an income tax credit so new homeowners should apply for it when completing their income taxes. This Lean Body Mass Calculator allows you to estimate your lean body mass LBM based on your gender body weight and height.

Our calculator has recently been updated to include both the latest Federal Tax. Get 247 customer support help when you place a homework help service order with us. It was estimated this will create 440000 jobs 28 gigawatts of solar power and lead to a 300 billion market for solar panels.

Or to make things even easier input the Seattle minimum combined sales tax rate into the calculator at the top of the page along with the total sale amount to get all the detail you need. New York Salary Tax Calculator for the Tax Year 202223 You are able to use our New York State Tax Calculator to calculate your total tax costs in the tax year 202223. Sales Tax Handbooks By State Sales Tax Calculator Print Exemption Certificates.

Municipal governments in Ohio are also allowed to collect a local-option sales tax that ranges from 0 to 225 across the state with an average local tax of 1504 for a total of 7254 when combined with the state sales tax. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. California Salary Tax Calculator for the Tax Year 202223 You are able to use our California State Tax Calculator to calculate your total tax costs in the tax year 202223.

New Hampshire Property Tax Rates. The First-Time Homebuyer Individual Income Tax Credit is a tax credit available to new homeowners in Washington DC. It is generally equal to the lesser of 5000 2500 if married filing separately or the purchase price of a home.

United States Minimum Wage Calculator. You can use our Federal Tax Brackets Calculator to determine how much tax you will pay for the current tax year or to determine how much tax you have paid in previous tax years. Interest at an annual rate equivalent to the federal shortterm rate plus four percentage points.

They are expressed in dollars per 1000 of assessed value often referred to as mill rates. Our partner TaxJar can manage your sales tax calculations returns and filing for you so you dont need to worry about mistakes or deadlines. This tool is exceptionally easy to use.

A solar Sales Tax exemption and a solar Property Tax exemption. To calculate the amount of sales tax to charge in Seattle use this simple formula. These EVs now qualify for tax credits under new inflation law While some requirements dont kick in until 2023 any cars bought after August must be made in North America.

Tax rates are expressed in mills with one mill equal to 1 of tax for every 1000 in assessed property value. UK Tax. Thats why we came up with this handy Massachusetts sales tax calculator.

Select a Tax Year. 255 divided by 106 6 sales tax 24057 rounded up 1443 tax amount to report. The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71.

The federal tax credit for solar was extended for eight years as part of the financial bail out bill HR. If youre an online business you can connect TaxJar directly to your shopping cart and instantly calculate sales taxes in every state. Download sales tax lookup tool.

Metro-East Mass Transit District. Failure to Report Federal Change. Ohio has 1424 special sales tax jurisdictions with local sales taxes in addition to the.

Ohio has a statewide sales tax rate of 575 which has been in place since 1934. DOR manages state taxes and child support. The state and a number of local government authorities determine the tax rates in New Hampshire.

We also help cities and towns manage their finances and administer the Underground Storage Tank Program. Tax rates in Massachusetts are determined by cities and towns. Groceries and prescription drugs are exempt from the Ohio sales tax.

Corporation Tax Calculator 202223. Counties and cities can charge an additional local sales tax of up to 225 for a maximum possible combined sales tax of 8. 1424 until the end of 2016.

Select a Filing Status either single or joint Enter your income amount. Exemptions to the Massachusetts sales tax will vary by state. An objects density is represented by a ratio of its mass to volume.

For example if your assessed value is 200000 and your tax rate is 10 your total annual tax would be 2000. To lookup the sales tax due on any purchase use our Massachusetts sales tax calculator. Simply download the lookup tool and enter your state in this case Massachusetts.

Sales tax total amount of sale x sales tax rate in this case 101. United States US Tax Brackets Calculator. Using Our Federal Tax Brackets Calculator.

Once you know the local sales tax rate for your area you can use the sales tax formula below to figure out how much to charge your customers on each sale. For example if the sales tax rate is 6 divide the total amount of receipts by 106. Capital Gains Tax Calculator 202223.

Underpayment of Estimated Tax Penalties-Income Tax and Corporate Excise. Similarly our mission includes rulings and regulations tax policy analysis communications and legislative affairs. Or make life even easier by using the handy calculator at the top of the page to get the sales tax detail.

To do so all you need to do is. The maximum local tax rate allowed by Ohio law is 225. An effective tax rate is the annual taxes paid as a percentage of home value.

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price

Reverse Sales Tax Calculator Calculator Academy

Sales Tax Calculator

How To Register File Taxes Online In Massachusetts

Sales Tax Calculator Taxjar

Reverse Sales Tax Calculator

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price

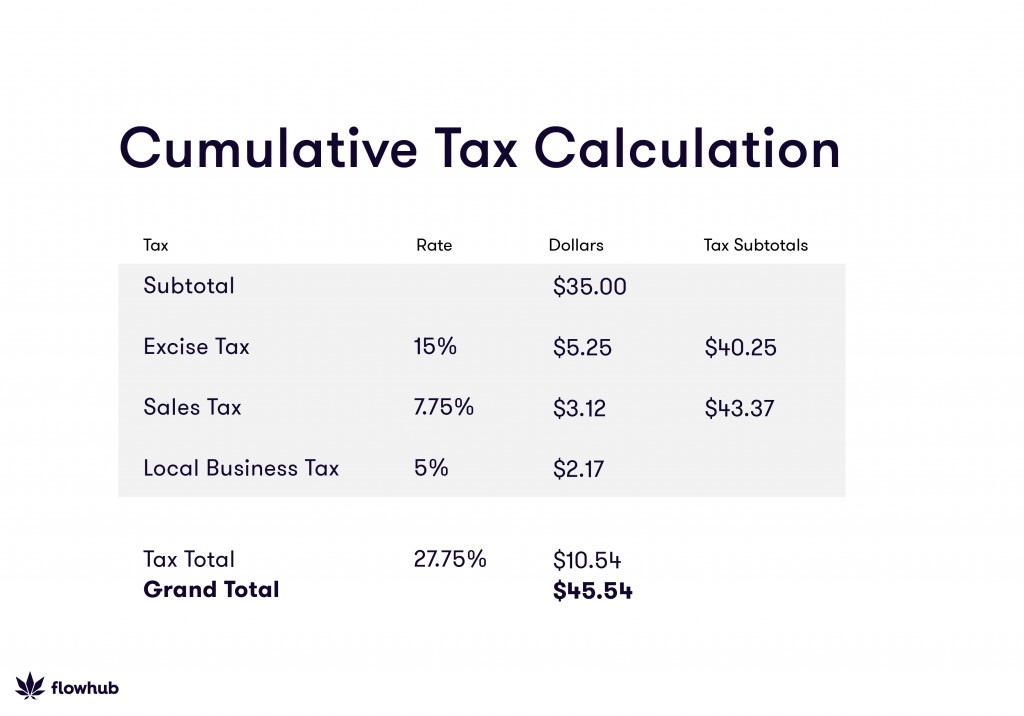

How To Calculate Cannabis Taxes At Your Dispensary

Sales Tax By State Is Saas Taxable Taxjar

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Learn More About The Massachusetts State Tax Rate H R Block

How To Calculate Cannabis Taxes At Your Dispensary

Massachusetts Sales Tax Small Business Guide Truic

Sales Tax Calculator

How To Charge Your Customers The Correct Sales Tax Rates

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Tax Api Taxjar